The Negative Effects of Industry 4.0 Tax Incentives in Italy: The Case of MES and Public Opinion

Introduction

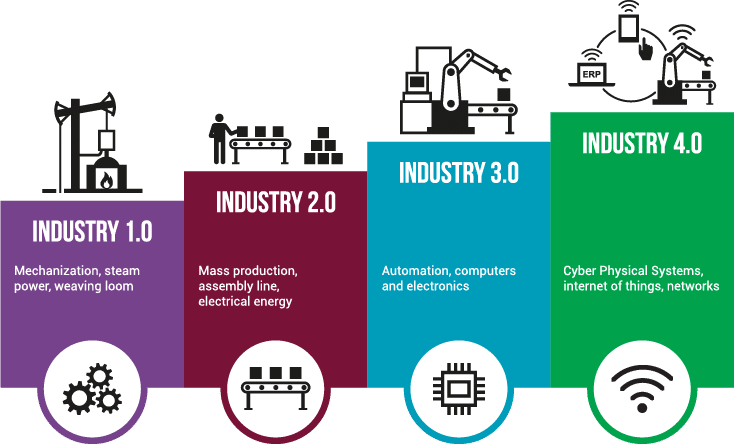

The Industry 4.0 initiative in Italy was designed to accelerate technological transformation and enhance competitiveness through tax incentives. Tools like Manufacturing Execution Systems (MES) have been heavily promoted under this plan, offering companies significant tax benefits. However, public opinion is increasingly skeptical, with many believing that these systems are adopted primarily to meet tax credit requirements rather than for their actual operational value. This article explores how Industry 4.0 tax incentives have inadvertently led to superficial innovation, market distortions, and potential inefficiencies in the Italian industrial landscape.

1. MES: Innovation Tool or Tax-Driven Formality?

MES, a software used to monitor and control production in real-time, offers significant potential for optimizing production processes and resource management. Despite these benefits, many companies have adopted MES primarily to qualify for tax incentives, such as the super- and hyper-amortization rates offered by the Industry 4.0 plan. These benefits provide deductions of up to 150% for the value of investment in digital equipment and technologies.

In 2020, around 16,000 companies received tax credits for investing in 4.0 technologies, with an average credit of €60,000 per company. This demonstrates the significant financial benefits provided by the government. However, instead of fully integrating MES to enhance production, some companies are merely adopting the systems to fulfill the requirements for these incentives. The result is a superficial use of MES, with the focus being more on obtaining tax credits than on the actual optimization of business processes.

2. The Incentive as an End Rather Than a Means

The tax incentives associated with Industry 4.0 have turned into an end goal for many businesses, with innovation taking a backseat. The incentives offer a clear financial reward, but companies may not fully utilize the technologies they adopt. MES systems are often installed to meet the minimum criteria for tax credits, such as interconnectivity and real-time data management, but without a genuine strategy for improving operations.

For example, a company might implement MES to access a 50% tax credit for software purchases under the 4.0 plan, but without making the necessary internal changes to fully integrate the system into its workflow. This has led to a disconnection between the government’s goal of promoting digital transformation and the reality of how companies use these systems.

3. Public Perception: Innovation or Opportunism?

This disconnect has fostered a growing public perception that MES and other 4.0 technologies are adopted for opportunistic reasons. Many small and medium-sized enterprises (SMEs), especially in sectors with thin profit margins, feel pressured to implement MES only to benefit from the tax cuts. Without a clear innovation strategy, these businesses are unlikely to see substantial gains in efficiency or productivity. In fact, some workers and managers view MES systems as burdensome and unnecessary, implemented solely to reduce taxes.

This sentiment is particularly prevalent in southern Italy, where economic disparities make it harder for businesses to invest in sophisticated technologies. As a result, the benefits of Industry 4.0 are disproportionately enjoyed by wealthier, northern regions, exacerbating existing inequalities.

4. Market Distortions and Superficial Innovation

The widespread, tax-driven adoption of MES has created market distortions. Instead of fostering genuine competition based on innovation, the Industry 4.0 tax credits have encouraged a “minimum-effort” approach to technology adoption. Companies do just enough to meet the tax credit requirements, but without a comprehensive plan for long-term technological integration.

The superficial nature of this innovation means that while companies are investing in MES and other 4.0 technologies, they often fail to reap the full benefits of digital transformation. This reduces the competitive edge these technologies are supposed to provide and leads to wasted resources.

5. Long-Term Inefficiencies

The risk of inefficiencies looms large. Once the tax incentives expire, companies that adopted MES only for tax benefits may find themselves with underutilized systems. Many firms lack the technical expertise or strategic foresight to fully integrate these systems into their operations, resulting in a mismatch between the technological potential of MES and its actual use.

For instance, in 2023, the tax credits for material goods were halved, dropping from 40% to 20% for investments up to €2.5 million. As these incentives are reduced, companies that have not maximized the potential of their MES systems may struggle to maintain operational efficiency.

Conclusion

The tax incentives for Industry 4.0 in Italy, while designed to promote digital transformation, have led to several unintended negative consequences. Public opinion increasingly views tools like MES as means to obtain tax credits rather than to genuinely improve business processes. This opportunistic approach risks undermining the true potential of Industry 4.0 technologies, leading to superficial innovation, market distortions, and long-term inefficiencies.

As the government continues to refine its approach to incentivizing technological adoption, it will be crucial to ensure that businesses do not merely chase tax credits but genuinely engage with the transformative potential of tools like MES.

Sources:

Horsa Blog: MES and Transizione 4.0 requirements